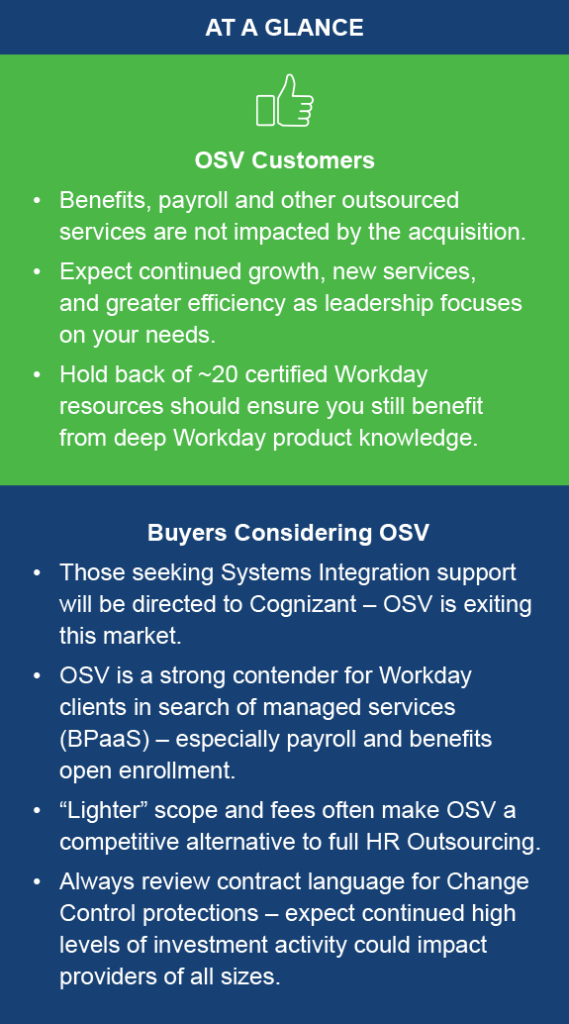

For as many as 1,300 OneSource Virtual (OSV) customers, the announcement that Cognizant will buy its Workday professional services and consulting business is easily missed. Timing-wise, the acquisition was announced immediately following OSV quarter-end sales (Halloween) and just before politically charged mid-term elections. Moreover, Cognizant is still not a widely recognized brand in HR circles or within the Workday ecosystem despite its 2020 acquisition of long-standing Workday partner, Collaborative Solutions.

What just happened?

Press releases tell us that Cognizant has entered an agreement to acquire the professional services and application management practices of OneSource Virtual. In layman’s terms, this is the technical deployment business that requires certified Workday professionals to configure and integrate Workday customers to go-live.

It also includes the application management solutions (AMS) efforts that existing Workday customers will leverage for new releases, configuration changes, and integration support to maintain their Workday solution. Roughly 400 employees, largely consisting of certified Workday deployment professionals will join Cognizant upon closure of this deal, currently expected by year end.

But wait — there is more to OSV than the technical solutions Cognizant will acquire. Another 600+ employees remain with OSV’s thriving managed services business, often described as the BPaaS – Business Process as a Service. Outsourced support for Workday, particularly in benefits and payroll administration has been a pillar of OSV’s value proposition to customers choosing the Workday platform but without the appetite to retain staff for open enrollment, payroll and tax processing, related inquiry support, and more.

What is the rationale?

If you are still scratching your head over a Workday boutique selling roughly one-third of its specialized Workday talent to a giant India-based technology company, you are not alone. Founded in 2008, Dallas-based OSV was one of the first to offer to run HR operations processing using the customer’s own Workday solution. Since then, OSV BPaaS services have expanded to customers in Canada and the United Kingdom; increased adoption of Workday Finance modules is pushing OSV BPaaS services into operations support for Accounts Payable where invoices are entered to Workday with the help of proprietary OCR tools, and for invoice payment services. Generally, the market for BPaaS solutions for Workday has seen growth of 30% year-over-year. Resources to deliver these services require process and compliance expertise and efficiency-minded HR and Finance professionals with service-oriented DNA. Today, OSV’s BPaaS business is roughly 68% of its annual revenues comprised of service contracts with a typical duration of 2-5 years which command a higher multiple of valuation.

In sharp contrast to BPaaS, the technical deployment business requires a consistently strong bench of resources with Workday certifications who are matched to the staffing needs of one-time Workday go-lives. Deployment projects can be large revenue events with high-stakes deadlines and contingencies, particularly for new Workday go-lives. The pipeline and sales channels required to pursue and win a steady stream of transition projects is only somewhat offset by ongoing AMS support services. Compared to its BPaaS business, OSV is exiting the smaller third of its revenues which requires resources that are in high demand and harder-to-keep.

Presumably, this is where a technology giant like Cognizant has the means to turn OSV’s flat growth engine into something greater. Gobbling up additional Workday expertise is a means to direct expansion of the 1,000-person Collaborative Solutions business acquired in 2020, which had a similar base of U.S. clients in addition to operations in Australia, Canada, and the U.K. The career path and opportunity for technical resources is infinitely greater as part of a large IT firm at a time when talent is fickle. Finally, Workday customers may reap the benefits of the Cognizant’s technical acumen in the form of efficient project management, deep data security expertise, and low-cost support for testing, data conversion and integration.

What to expect going forward

Looking through an OSV lens, there is great potential to sharpen its focus on the rapidly growing demand for Workday BPaaS services. Expect OSV to continue to align and grow its business with Workday product development and geography (which to date is still quite North America centric).

Top of mind challenges for the newly focused OSV business will be a re-imagining of new business pipeline and offerings. Without direct attachment to the config-and-deploy projects for new Workday customers, OSV will have to rely on sales channels that expand BPaaS services for existing clients and find ways to connect with Workday clients that are ready to explore a partially outsourced delivery model. Other considerations may include further growth in BPaaS for Workday finance products, contact center services, or the repositioning of proprietary tools and accelerators such as its OCR process automations, its own compliant tax engine, and other embedded delivery components

Alliances are commonplace in today’s market for various combinations of technology and services. A partnership agreement with Cognizant sure to be part of the final agreement but may not be exclusive for either party. Cognizant has previously gone to market with Alight Solutions, a direct competitor of OSV for Workday BPaaS services.

One last callout – to some, the timing of the Cognizant-OSV acquisition is curious as it comes amid some extremely high-profile leadership changes. Recently, it was announced that former Infosys president, Ravi Kumar, will be joining Cognizant as the president of Cognizant Americas on January 16, 2023. In the circle of competitive India IT companies, a significant leadership announcement is bound to overshadow a niche acquisition that strengthens Cognizant’s HR technology portfolio.

For strategic insights specific to your HR technologies and providers in all geographies, contact us.